Property owners in Jefferson Township can appeal their assessments to the Cook County Board of Review, but only until February 2. Local aldermen have sent out information about how to appeal and a lot of my neighbors have likely received something in the mail. But even with a lot of publicity, the whole thing is still very daunting, and my observation is that most people don’t even consider doing it.

We appealed in 2015. And we won. I would estimate that as a direct result we saved $400-$500 in property taxes for Tax Year 2014. I spent time preparing the appeal, and I did request a hearing, but I did it myself. And for most people, their best available argument is something which requires no hearing. The entire appeal can be done online, and can be done in less than 15 minutes.

But I am taking it a step farther, and making it more realistic for more people to be able to file the simplest kind of appeal. I’m going to explain exactly what this “simple” appeal is, and for many of my most immediate neighbors, I will also provide the information that can help them make such an appeal.

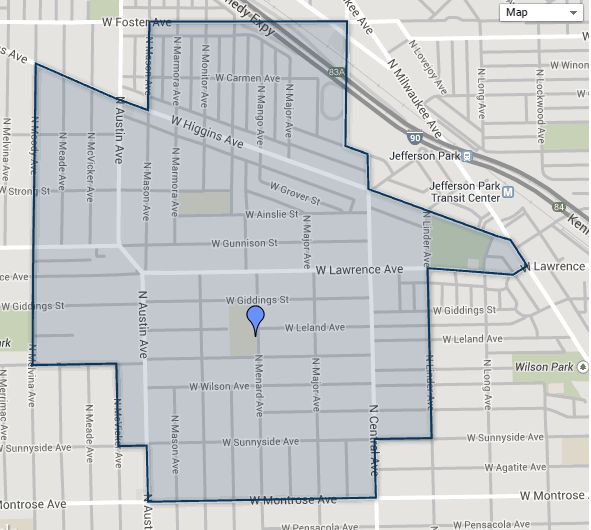

Jefferson Township, for those unaware, includes these community areas: Jefferson Park, Avondale, Logan Square, Hermosa, Forest Glen, Dunning, Albany Park, Portage Park, Irving Park, Montclare, and Belmont-Cragin. That’s a whole lot of you!

Before I go any further, I want to be clear on a couple of points. First, I am not an attorney, and I have no background in real estate, assessment, or anything related. Any and all advice provided here is lay advice only and should not be interpreted as formal legal advice. Second, I am not going to try and explain all of the various reasons why an appeal might be made. I am going to specifically talk about only two, because they are the two which worked for me last year.

The reason I am doing this is because I think a lot of property around me is significantly over-assessed, and I believe that systemic over-assessment of property is a mechanism by which taxing authorities squeeze property owners. If more of my neighbors start filing appeals, I believe that the result will be a slight overall lessening of assessments in the area, which will be good for the collective neighborhood. Assessment and appraisal are not the same thing. In my opinion, it can hurt more than it can help if your property is over-assessed, because that over-assessment may make it less attractive than a comparable property, as it means prospective buyers would have to expect to more in taxes. This is a point on which I think reasonable people can disagree, and for people who disagree with me, I respect where you are coming from. But given that every elected official under the sun encourages people to file appeals, it clearly is not seen as a bad thing by government generally that people will appeal. And the bottom line is, it’s simply being a good neighbor to help people who may not understand how easy it can really be to file.

And one final thing: FILING AN APPEAL IS FREE so long as you file it yourself. There is no filing fee! So it is a no-risk situation.

Appeal Rationale #1: Recent Purchase

This rationale can only be used if you purchased your house since the beginning of 2012, though, so it won’t work for most people. But it is very simple.

If you bought your house for $200,000, and it is now assessed for $230,000, then you are most likely over-assessed, and the Board of Review will agree, and lower your assessment.

When I appealed last year, I requested a hearing, and prepared a lot of documentation. Notably, I had to make a copy of the Bill of Sale on the house, which showed the purchase price and the date. I am not going to go into a lot of detail on that here as I have not gone back and re-researched what documentation needs to be pulled together. What I will say is, the documentation requirements are such that this is not the “simplest” way to appeal. But it is the simplest of arguments, which is why it is such an important one to pursue.

As I go on further below and talk about actually using the Board of Review website, keep in mind there may be additional things you will need to do involving submission of supplementary documentation. As I said above, I’m not a lawyer. I’m not telling you absolutely everything about how to do this. I am just trying to provide more concrete information so that you can be more successful if you choose to do it yourself.

Appeal Rationale #2: Comparable Properties aka Lack of Uniformity

We live on a street that is all Single Family Homes (SFHs) and almost all of a very comparable size (slightly over 1,000 square feet). They’re almost all technically bungalows, but not the classic brick ones; what we have here are a lot of basic A-frame houses dating from the 1920s.

Our house does not have a finished attic or a finished basement. We have central air, but I suspect everyone on the block does, or nearly everyone. Long story short, our house is eminently comparable with the rest of the block, and boasts nothing exceptional that might cause it to sell for substantially more than another house. Therefore, it should be assessed pretty much in line with the rest of the block, or even on the low end, as I know several of the houses do have their attics and/or basements finished, or a deck in the backyard, or other things.

In 2015, I was able to find 6 comparably-sized houses on my block alone which had lower assessments than ours. These included both adjoining houses. So in my appeal, I identified these houses by their PINs (PIN is short for Property Identification Number).

The appeal based on comparable properties, as it so happens, is the easiest type of appeal to file. It requires no additional paperwork and no additional narrative. The argument is based solely on data which the Board of Review has at their fingertips anyway – the assessed values of the other properties. All you have to do is identify relevant properties and submit their PINs.

Here is where I can provide the most help, especially for those of you who live closest to us.

Again, I am not an expert on these matters. I am strictly a layman and my advice should be regarded not as expert advice but rather as common sense advice.

Very generally, there are five things that can make properties especially comparable. First, they are in the same neighborhood, maybe even the same block. Second, they are about the same size, as measured in primary square footage. Third, they are in about the same shape maintenance wise. Fourth, they are about the same age. Fifth, they have about the same amenities, especially things like a garage, a deck, a finished basement, a finished attic, a similar number of bedrooms and bathrooms, etc. None of these things should come as a surprise. If your property is sufficiently comparable to another, and the other property is assessed lower, the determination can be made that a “Lack of Uniformity” has been found, and upon that basis, your assessment can be lowered.

I was able to gather all of the information I needed from the Cook County Assessor’s Website. Choose “Property Address Search”. For House Number, enter your hundred block, say 1000. For House Range, enter the last possible number of your hundred block, say 1099. The rest is pretty straight-forward. You don’t need to select a Property Class and you may be better off not selecting one and instead seeing absolutely everything, for reasons I’ll get into below.

Now, you can also enter a range that spans multiple blocks, say from 1000 to 1499. Or you can choose some other street. In any case, if you use valid search criteria, you will get a list of properties with their PINs, Addresses, Property Classes, and Assessed Values. Remember, Assessed Value needs to be multiplied by 10 to get Fair Market Value. So if you see an Assessed Value of $24,000, it really means that the Assessor’s Office guesses your property is worth $240,000.

Each PIN is also a hyperlink. Click through and you’ll see a picture of the property with a lot more details about it. Now, you know your immediate neighborhood better than I do (hopefully!) You may not even need this deeper information. If you live on a row of little brick bungalows and you know the houses are all reasonably comparable, then, well, you already know it.

What you would be looking for here is to find multiple nearby properties which are superficially comparable to yours, and which have lower assessments. By “superficially comparable” what I mean is that even without deep digging, you know that they’re close, of a similar size, most likely of a similar age (since most houses on most streets tend to be of a similar age anyway), and even most likely in similar shape with similar amenities. If there was a house on your block which had been gutted by a fire in the last couple of years, you’d know it (again, hopefully!) and would understand to exclude that one.

It may be that you need to look beyond your immediate block. This is where the whole process can get very tedious, and this is where I can be of particular help.

This link sends you to an Excel file. That Excel file includes a listing of 4,171 distinct properties in Jefferson Park and Portage Park, all of which are within or nearly within the street from the primary attendance footprint of Prussing Elementary School, which looks like this:

Instead of having to conduct a bunch of different searches on the Assessor’s website, you can just take the spreadsheet and slap some filters and sorts on it. It may be easiest to sort by Street Name, then Street Number; and to simultaneously filter for the two most similar property types. Or filter by Street Name (select a couple of relevant ones) and also Property Class, and then sort by Assessed Value.

I want to stress here that I have not “captured” any bad or illegal or improper information. All of this was readily available on the Assessor’s website. It took me a total of maybe 90-120 minutes of work to compile all of the data in this manner. Anyone who has read on this far must be serious enough about wanting to appeal their assessments that they would have been likely to find the exact same information themselves. But here it is easier to sort, easier to make sense of. This is the piece which I think can take it over the top and make it so that a person on the fence about whether it would be too difficult to do all of this can actually just do it for themselves.

It was much too difficult to try and grab more than I grabbed. The Prussing footprint made a lot of sense to me, though, because a) all of the properties feed into the same school, which makes them very comparable in that respect; and b) this is where I live and the people I hope will be best able to take advantage of this information will be my closest neighbors!

It is not a bad idea, if you have identified 10 or so properties which you feel may satisfy the comparability parameters, to go back to the Assessor’s website and enter the PIN numbers directly and make sure there’s not something weird about them. For example, I have noticed in looking through the list several situations where a single house actually lies on two lots, and although it has only one address, it somehow has two PINs. That’s not going to be comparable for most people. You also need to make sure the Property Class is the same or at least very similar.

One other word on Property Class. Our house is a 2-03 meaning a SFH between 1,001 and 1,800 square feet. But it’s way at the low end of that. A 2-02 house with 950 square feet is more comparable than a 2-03 house with 1,100 square feet. That said, it’s super unlikely that a house much larger than ours could possibly be assessed for less than ours. It’s people with houses in the 950 sq ft range who might find nearby houses in the 1050 sq ft range which have lower assessments.

And also another word about the spreadsheet. I included ALL properties, not just SFHs, so a lot of condos, and some retail, and some other weird stuff wound up in there. Don’t make the mistake of comparing your SFH against a condo, or a parking lot, or anything weird like that!

Filing Your Appeal Online

There may be very good reasons to NOT completely file your appeal online so just because I am going to explain how easy such filing is doesn’t mean it’s necessarily the best way to do it. With that said, if the extent of what you’re trying is the Comparable Properties rationale, filing online could very well be all you need, and the whole filing process might be super fast.

The body that takes appeals right now is called the Cook County Board of Review. This is all they do: review assessments.

The Board of Review offers Filing Procedures online. If you want to be really thorough, read what’s on these pages. I did last year, and so I wound up taking pictures of the other comparable properties. That’s a more impressive approach, one that they’ll pay more attention to. You don’t absolutely have to do all of that, but especially if you’re going to prepare a more thorough argument, do it by their book.

Note that February 2 is the deadline for filing a complaint. It is not the final deadline for submitting all evidence. If however you are only going to submit a list of comparable properties and just want to do the whole thing online up front, then it is my understanding that you should do that at the time of filing the complaint.

In terms of the very basics, start with the Appeals Page. You can create an account or you can file as a guest. Then click on Submit Appeal. Enter your PIN and mark your appeal type as “Property Over-Assessed” – an easy choice since it’s the only one available.

As you go through the steps, you will wind up at a Notes Page. On this page you can enter the PINs of Comparable Properties. The language there says simply “List comparable property index numbers (PIN’s) below, or provide additional comments regarding your submission.” So you are not expected at this stage to provide any more detailed information about those properties, as the Filing Procedures information might appear to suggest.

I went ahead and filed my complaint online on Thursday night. I provided a list of 6 comparable properties – though because I already won an appeal from the Assessor’s Office, it turns out that we’re already on the low end of assessments of comparable properties in the area.

But I also checked the box to say I would be filing additional documents. One nice thing about the online process is that you can submit documents online without having to mail them in or go in for a hearing. What I’ll be submitting – and this is admittedly unusual and not what most people would be able to do right now – is a scan of an appraisal done on house in mid-2015. You can also file other documents online if you have them – this could include paperwork related to your house purchase if it’s within the last 4 years.

In 2015 I requested a hearing. My hearing lasted about 2 minutes. After waiting in line for a while, when I got up to the counter, my hearing was with an employee of the Board of Review, and basically consisted of me handing over paperwork, providing a synopsis of what was in the paperwork, and answering a couple of perfunctory questions about the appeal (i.e. was my house bought in the last four years, such that an appeal based on the price of sale would make sense.) The employee did no evaluation at that time, except to say that if all I was telling him was true, I would likely be getting my assessment lowered. And he was right. But having gone through one in-person hearing, I am disinclined to go through another, not because it was difficult or tedious, but because the hearing itself was so insubstantial that I personally feel comfortable just filing my documentation online. Now, it might well be that you’re better off for having an in-person hearing. I can’t tell you for sure. I can only say that I feel comfortable this year without one.

More on My Thinking

It may seem like this was a lot of writing and a lot of effort to just explain something esoteric to people. I want to here expand on a couple of my thoughts above and explain more about my motivation to try and help people with all of this.

Based on my past bills and the knowledge that property tax rates are going up, I conservatively estimate that for every additional $10,000 of assessed value, a homeowner carrying the homestead exemption will pay an additional $200 in annual property taxes. (As an aside – if you own the home you live in and you do NOT have the homestead exemption – MAKE SURE YOU ADDRESS THIS! Look it up! It will save you a lot of money because there is a significant tax break for people who own the home they live in. A lot of people overlook this.)

I mention above that my own appeal this year is based largely on a recent appraisal. Even though I was successful in getting the Assessor’s Office to lower our assessment already, I still feel our assessment is too high, and I feel the appraisal bears this out. Our house was appraised for $210,000. Our current (reduced) assessment is just about $220,000. That’s a difference of $10,000, which I think will translate into about $200 a year in taxes.

Here’s the thing. The assessment is conceptually supposed to be pegged to the Fair Market Value (FMV) of the house. It is super unrealistic for the Assessor’s Office to go around and evaluate every house individually for its FMV. So what they do is they take the old assessment, and if it’s a year in which your township is being reassessed, they come up with some formula by which to raise the assessments of a lot of comparable properties.

I did some investigating and found that on my block, the Assessor’s Office simply raised everybody’s assessment by 8%. Now, it might very well be the case that the FMV of houses on my block has legitimately increased 8% in the last three years. But what if the block had been overassessed in the first place?

See, we bought our house in 2011 for $195,000. That was near the bottom of the market, so it makes sense that it has appreciated since. Indeed, our appraisal was for $210,000. That’s an increase of 7.7% – pretty much in line with the multiplier the Assessor’s Office used.

But our house was clearly overassessed as of the time we bought it, because we paid less for it than the assessed value. This makes sense, of course, since it was near the bottom of the market at the time. Assessments are very inexact are only done every 3 years. A neighborhood can get very hot very quickly. It can also get very cold, if the local school collapses, or there’s a rash of crime, or something like that.

My feeling, though, is that my entire block is overassessed. Now, real estate isn’t my gig. I don’t closely follow local purchase prices. But I did notice that the very next block over wasn’t subject to the same 8% increase as my block. And the homes on that block are worth more – they tend to be brick, slightly newer, etc. And the Assessor’s Office frankly agrees with me; after all, they did lower our assessment from what they had originally come up with, which strongly suggests that some of my neighbors on my block could at least get a similar reduction.

If I thought every house on this block could definitely fetch in sale what it’s assessed at, I would just say okay, it’s all good. And believe me, I’d be very happy to be proven wrong. The real estate site Trulia, using whatever bizarre metrics it uses, estimates the value of our house at $250,000 – way more than any other number I’ve seen. If I could legitimately get $250,000 for the house by selling it tomorrow, then I would accept paying taxes appropriate to such a valuation today. (I won’t say happily pay, because all of our property taxes should be slashed in favor of a state income tax increase – but that’s an argument for another time and day!)

I have heard the argument that if all of the assessments were lowered that it would also in the process sink the price people could get for their homes. I don’t know enough about the real estate market to completely refute this, so my argument should be regarded in that light. But I can say that we did not consider the assessment when we bought our house. We considered the purchase price (because we were operating within a budget) and we considered the appraisal. My feeling is that the market itself will correct for most incorrect assessments, and only if given assessments are very wildly off would there be an issue.

Consider this: What if we spent $20,000 this year and got our basement completely refinished and did some other work besides? For the sake of argument, let’s say that such improvements would make the house worth $20,000 more on the open market. But would it actually impact our assessment? In the short term, certainly not, because the house won’t be reassessed again for another three years. Even then, it’s not like anyone from the Assessor’s Office is going to come take a look at our basement. It’s very clear to me that many properties do not have up to date amenities on file with the Assessor and it’s unrealistic to expect that they would. Is the Assessor’s Office’s failure to take account of our substantial interior improvements likely to hurt our Fair Market Value when it comes time to sell the house? I can’t remotely imagine a real estate agent trying to sell our property telling us we can’t sell it for more because we haven’t been adequately reassessed lately.

The point is that the assessment process is necessarily just a bunch of guessing. Maybe that 8% increase in property valuation isn’t totally unrealistic, but maybe the starting point simply wasn’t right, and they can’t account for things like the higher demand for certain amenities that we don’t have (like a finished basement or finished attic?)

It’s not that I think we and our neighbors should be able to shirk on taxes relative to the next block or neighborhood or whatever. Rather, I feel that the taxation system we operate under is so arbitrary – and maybe so necessarily arbitrary – that it is not only appropriate but indeed desirable to have a neighborhood or especially a block fighting together for fairer taxation. It’s not going to hurt our neighborhood school, the money for which comes from a much larger pool. And it’s not going to hurt our ultimate selling prices, for those of us who do eventually sell.

Again, I freely admit, I might be wrong about some of this. But I would submit that many elected officials strongly encourage homeowners to appeal their assessments. That’s a tacit acknowledgment of the arbitrary nature of the whole model, isn’t it?

Wouldn’t it be nice if everyone on my block could save just a little bit – maybe as little as $50 a year – and then turn around and apply those savings to something like having a really awesome block party every year? That kind of thing would enhance the value of our neighborhood, and not just in a monetary way. As the neighborhood gets stronger, it will have a carryover effect in making our elementary school stronger as well. Yes, the eventual outcome of all this would be that our properties would actually be worth more, and we’d wind up more highly assessed as a result. But that would all be because this had become an even better place to live. Surely that’s a goal worth striving for.

I hope this long-winded explanation of the appeals process can be of use to people, especially people close to me. Maybe even in a small way, it can be a catalyst for a stronger neighborhood. At the very least, if it helps to empower just one family to pursue an appeal, and they ultimately win, this has all been worth it. Chicago is a great place to live in a lot of respects, but it is often a terribly disempowering place. Democracy, schools, neighborhoods, blocks – all of these things are better served when people are more empowered.